In December 2015, a daring new chapter started in Ghana’s insurance coverage business. LeapFrog Investments, a world personal fairness agency recognized for its profit-with-purpose method, made a strategic acquisition of miLife Insurance coverage.

The imaginative and prescient was clear: inject innovation, capital, and international experience to construct a enterprise that might drive each monetary success and significant social influence.

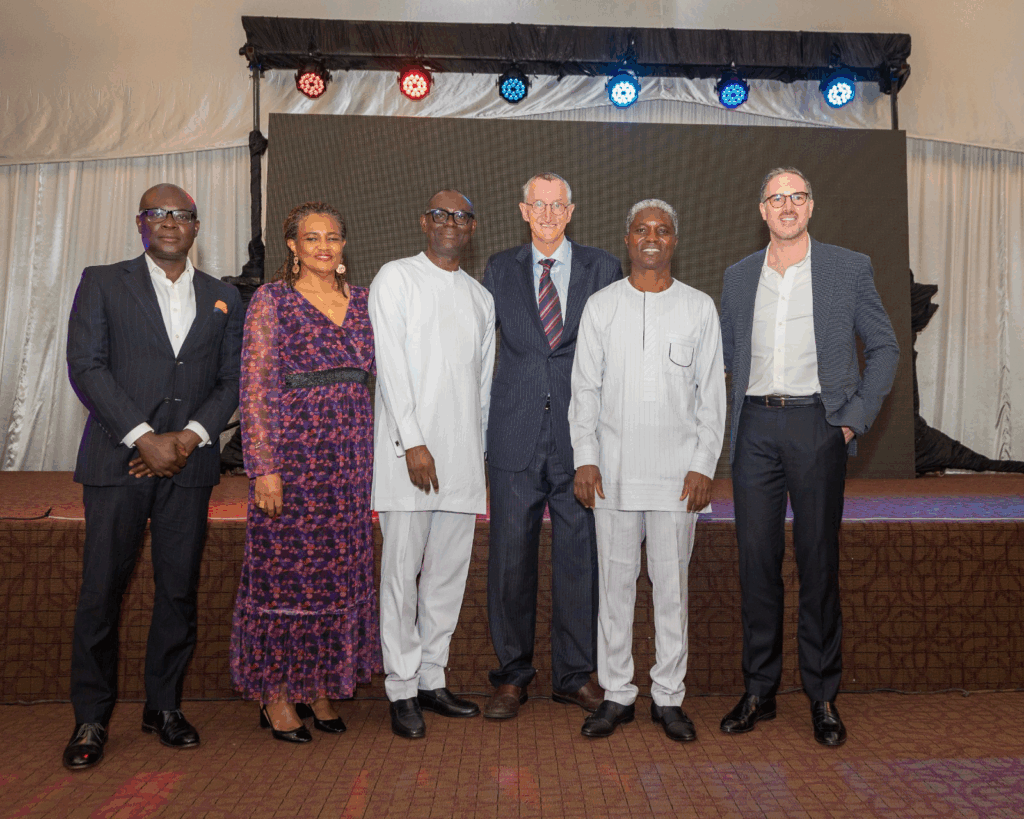

A month later, in January 2016, a seasoned skilled with a quiet however commanding presence stepped into the function of CEO.

His title is Kwaku Yeboah-Asuamah. With a profession spanning over 20 years in insurance coverage, finance, and pensions, Kwaku introduced not simply technical experience but in addition imaginative and prescient, self-discipline, and coronary heart.

Along with the broader administration workforce and LeapFrog, what adopted over the subsequent 9 years was nothing in need of extraordinary.

A outstanding transformation

Below Kwaku’s management, the corporate skilled fast and sustainable development. In 2016, miLife’s annual premium revenue stood at underneath GH¢20 million, and by the tip of 2024, that determine had soared to GH¢406 million—a staggering 21x development. Throughout this era, the corporate rebranded as miLife Insurance coverage, a reputation that higher displays the corporate’s renewed imaginative and prescient, mission and values.

This phenomenal development didn’t occur by likelihood. Kwaku led a strategic overview of the corporate’s product choices, making certain they mirrored the true wants of on a regular basis Ghanaians. Below his management, the corporate expanded its distribution channels by way of partnerships with cellular community operators and neighborhood teams and positioned a pointy give attention to gross sales productiveness. The consequence? A thirty-onefold improve in new enterprise, with insurance policies rising from 12,138 in 2016 to 375,535 in 2024.

Working intently with LeapFrog, miLife has applied many worth accretive initiatives, together with the enterprise rebranding, buyer excellence, company improvement and worker studying and improvement, to call a couple of

Profitability adopted go well with. Between 2016 and 2024, miLife recorded a cumulative underwriting revenue of GHS 81 million and working earnings of GHS 97 million. In the meantime, Property Below Administration grew from modest beginnings to GHS 459 million by December 2024, a testomony to prudent funding, diversification, and monetary stewardship.

Climbing the Ranks

These outcomes have seen miLife command a higher presence within the nation’s extremely aggressive market. miLife is now a top-five life insurer and has narrowed the premium hole to its opponents considerably, turning into a formidable pressure in a fast-growing business.

A Digital Edge with Goal

True to his forward-looking philosophy, Kwaku championed the usage of expertise not as a pattern, however as a software to drive inclusion, effectivity, and scale. Below his watch, miLife deployed transformative techniques comparable to Adepa for gross sales, underwriting, and billing; Mankrado for claims automation; and Ohemaa, each an online self-service portal (ohemaa.milifeghana.com) and an AI-powered chatbot (050 352 6465) that introduced buyer help to the fingertips of policyholders nationwide.

These platforms considerably diminished human errors, sped up coverage issuance, simplified claims processing, and enhanced buyer engagement, making certain {that a} lean IT workforce might ship most influence throughout the corporate.

Kwaku didn’t merely undertake digital innovation, he ingrained it into the very material of miLife’s tradition. Below his management, expertise grew to become a catalyst for influence, notably within the micro-insurance area, the place merchandise like miWay (Dial *165# on MTN to enroll or handle your cowl) and miFuture (Dial *462# on Telecel to enroll or handle your cowl) skilled exponential development. Every technology-driven initiative was purposefully designed to make insurance coverage extra accessible, reliable, and deeply human.

Placing Clients First

Kwaku’s legacy goes past numbers. From day one, he insisted that miLife should stay deeply related to its clients. He didn’t simply sit within the boardroom, he made common appearances within the subject. From Kasoa to Kintampo, he met with shoppers face-to-face, listening to their tales, answering their questions, and constructing belief.

He really believed, his personal saying that “insurance coverage is simply as worthwhile as it’s understood”. That perception formed miLife’s buyer schooling technique, which included neighborhood boards, native language radio reveals, digital campaigns, and in-market activations, that are all aimed toward demystifying insurance coverage and empowering individuals to make knowledgeable choices.

This hands-on management type not solely units miLife other than its Ghanaian friends but in addition builds a tradition the place buyer engagement and repair excellence have develop into non-negotiable.

A Tradition of Folks and Goal

Below Kwaku’s management, a powerful and distinct organisational tradition took root, one which prioritised worker engagement, motivation, and job satisfaction. He believed that an organization’s biggest asset is its individuals, and his management persistently mirrored that perception. His values and strategic priorities formed not solely miLife’s enterprise course but in addition its inner surroundings, fostering a office the place individuals felt seen, heard, and empowered to develop.

This dedication to individuals was not simply aspirational, it was measurable. miLife’s tradition entropy scores, a globally recognised indicator of organisational well being, steadily improved underneath his tenure: from 9% in 2019 to six% in 2021, and simply 5% in 2022. These low scores replicate a extremely engaged, values-aligned workforce with minimal inner friction, all hallmarks of a thriving and purpose-driven organisation.

By clear communication, funding in employees improvement, and an open-door management type, Kwaku constructed greater than an organization; he constructed a tradition the place excellence, belief, and influence might flourish.

A Rising Footprint and Product Vary At this time

miLife touches the lives of over 1.3 million Ghanaians. In 2024 alone, the corporate paid out GHS 184 million in claims, fulfilling its promise when households wanted it most.

miLife’s product suite now consists of funeral, schooling, endowment, and revenue safety plans tailor-made for each people and teams. Flagship choices like miTribute, miLegacy, miKids, and miFuture are accessible by way of an ever-expanding community of brokers, financial institution branches, and digital platforms, making certain that insurance coverage is inside attain for all, from the bustling cities to the remotest communities.

Goal Past Revenue

Kwaku additionally believed in giving again. Below his steerage, miLife’s company social accountability efforts took on deeper which means. The corporate grew to become a proud supporter of kid immunisation programmes in its host communities, serving to shield the youngest and most susceptible.

Since 2020, the corporate has distributed lesson notebooks, train books, footballs and soccer jerseys to over 650 faculties throughout the nation. From selling monetary literacy to supporting native faculties and well being outreach occasions, miLife underneath Kwaku grew to become a enterprise that didn’t simply serve its clients but in addition served its nation.

A Lasting Legacy

As Kwaku Yeboah-Asuamah steps down in Might 2025, he leaves miLife not solely greater and stronger but in addition extra revered, extra trusted, and extra human.

He leaves behind an organization with deep roots and vast attain. An organization that believes in innovation, inclusion, and integrity. An organization is prepared for the longer term due to the inspiration he constructed.

Certainly, Kwaku didn’t simply lead miLife, he reworked it. In doing so, he has left a long-lasting mark on Ghana’s insurance coverage business and on the lives of thousands and thousands who now have the safety and peace of thoughts that solely insurance coverage can convey.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially characterize the views or coverage of Multimedia Group Restricted.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially characterize the views or coverage of Multimedia Group Restricted.

Source link