In 2022, Ghana discovered itself within the midst of a extreme financial disaster that compelled the federal government to hunt a $3 billion bailout from the Worldwide Financial Fund (IMF).

Whereas rising debt and financial mismanagement had been main contributors, a important but typically missed issue was the position of bond vigilantes, traders who misplaced confidence in Ghana’s monetary stability and dumped the nation’s bonds.

This selloff triggered a surge in borrowing prices, a speedy depreciation of the cedi, and in the end, Ghana’s monetary misery.

Let’s discover how these bond vigilantes influenced Ghana’s economic system, their position within the 2022 disaster, and the broader implications for fiscal coverage and investor confidence.

Understanding Bond Vigilantes and their Affect

A bond vigilante refers to traders who dump authorities bonds once they imagine a rustic’s financial insurance policies are unsustainable.

This results in falling bond costs and rising rates of interest, making it costlier for the federal government to borrow. Bond vigilantes act as a test on fiscal irresponsibility by rising borrowing prices once they detect extreme deficits, inflation dangers, or debt misery.

Consider bonds like outdated CDs with fastened rates of interest at a financial institution.

- If banks increase rates of interest, new CDs will supply greater returns. Your outdated CD, which pays a decrease fee, turns into much less engaging, so when you wished to promote it, you’d should supply a reduction (lower cost) to draw consumers.

- If banks decrease rates of interest, your outdated CD with a better fastened fee turns into extra useful, and folks can be keen to pay further (a better worth) to get it.

Bonds work the identical means:

- When rates of interest go up, new bonds pay higher charges, so outdated bonds lose worth.

- When rates of interest go down, outdated bonds with greater charges grow to be extra useful.

This phenomenon is widespread in superior economies just like the U.S. and the UK, the place bond markets are massive and influential. Nevertheless, Ghana’s disaster confirmed that even in creating economies, traders—each overseas and home—can considerably affect monetary stability.

How Bond Vigilantes Triggered Ghana’s Disaster

Ghana had been borrowing aggressively for years, financing infrastructure tasks and authorities applications by way of:

- Eurobonds (loans from overseas traders in {dollars}).

- Home bonds (loans from native banks, pension funds, and people in cedis).

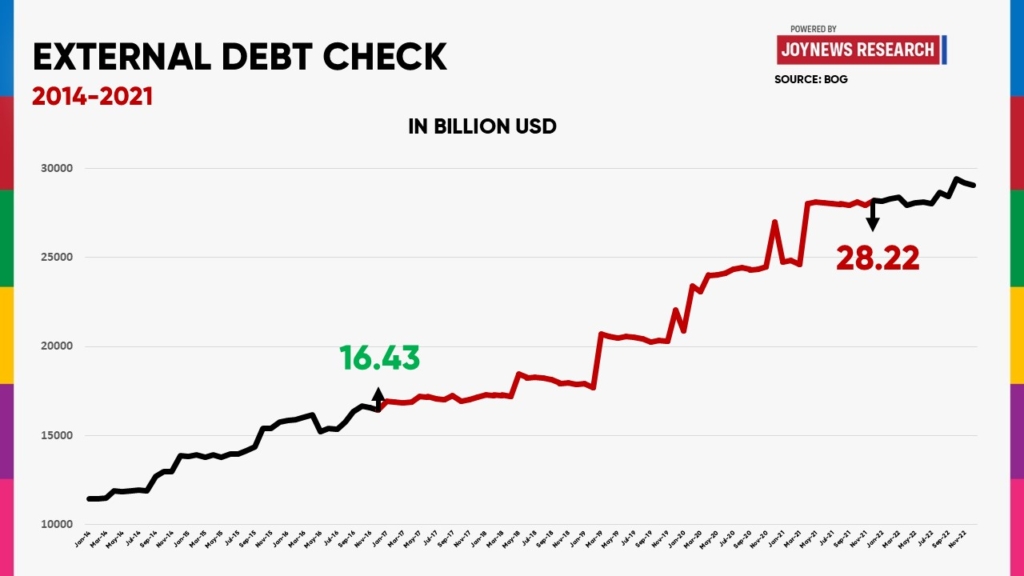

Between 2017 and 2021, Ghana issued a number of Eurobonds, rising exterior debt.

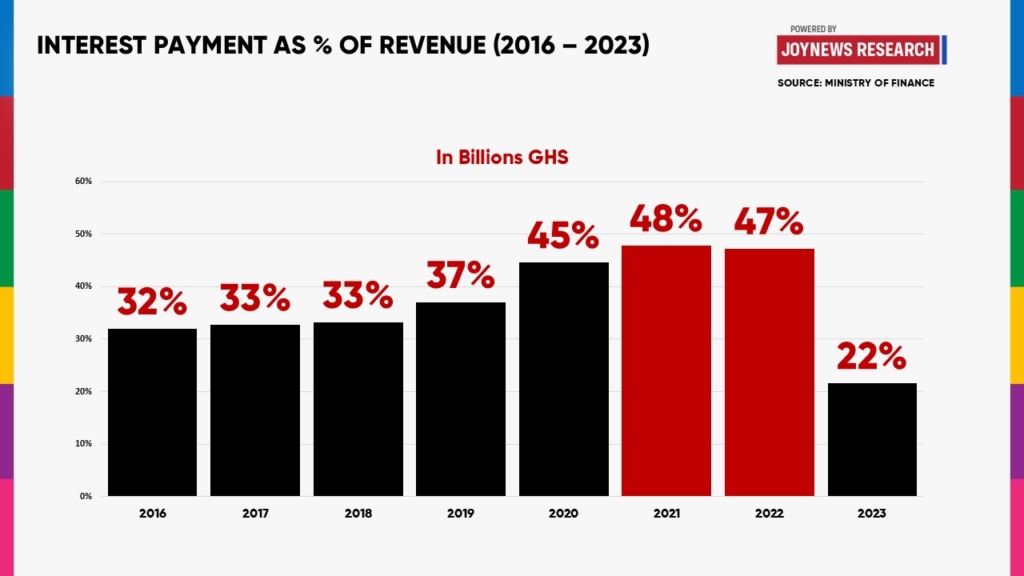

Whereas this initially helped finance improvement, it additionally raised debt servicing prices—by 2022, curiosity funds alone had been consuming practically half of presidency income.

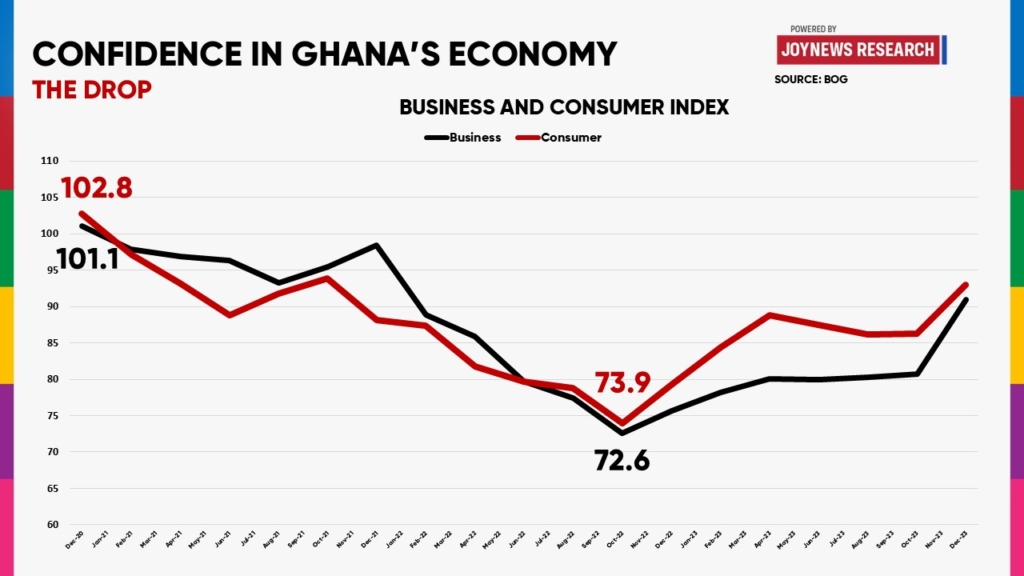

Lack of Investor Confidence & Bond Selloff

By early 2022, a number of warning indicators made traders nervous about Ghana’s capacity to repay its money owed:

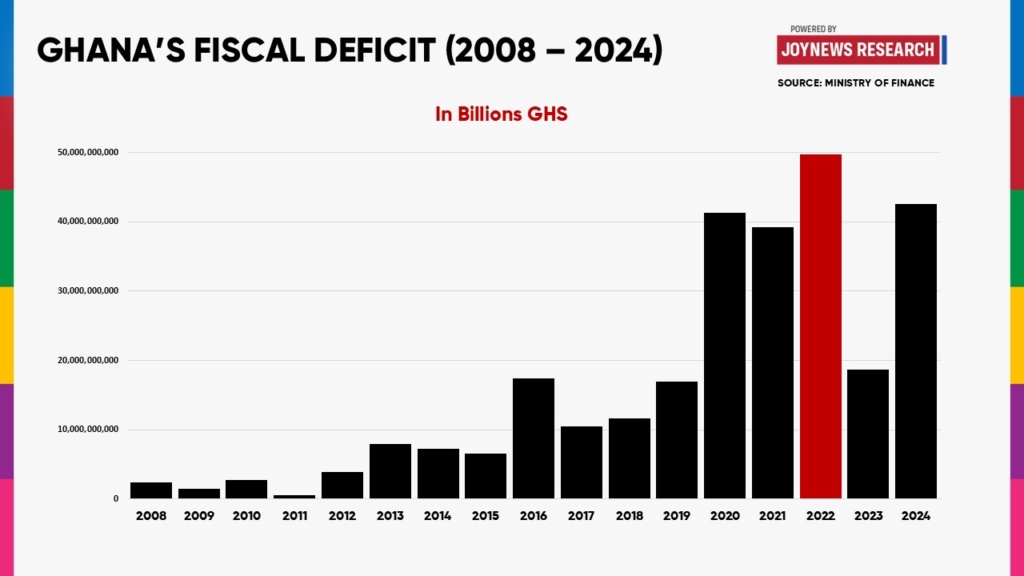

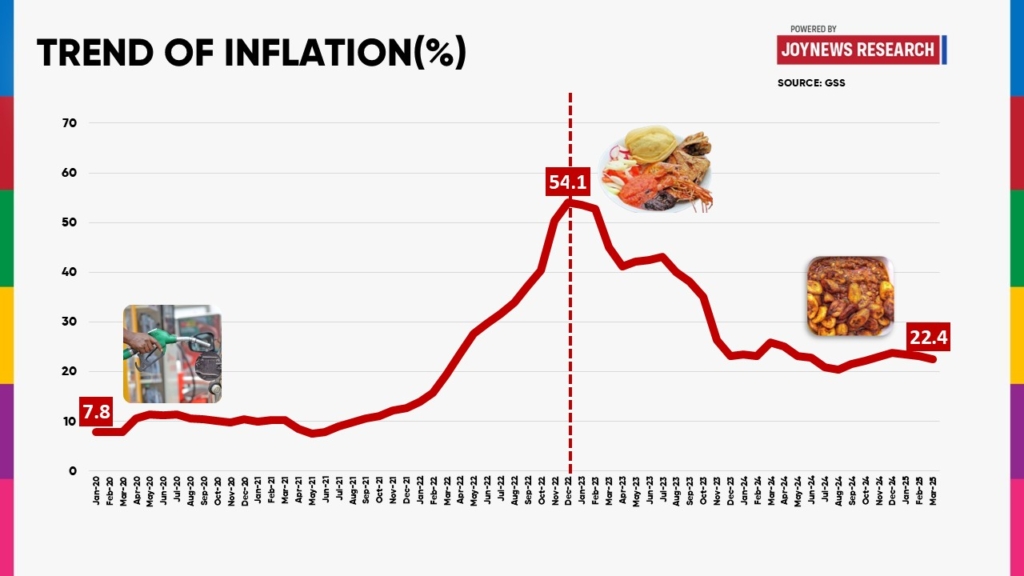

Hovering fiscal deficits are as a result of extreme spending.

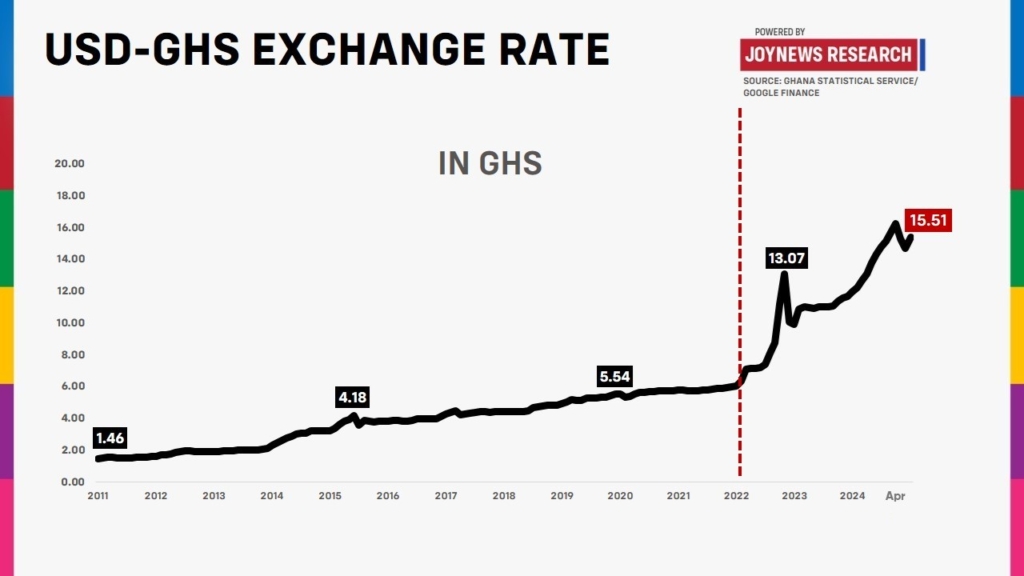

Rising inflation and foreign money depreciation.

In consequence, each overseas and home traders started promoting off Ghana’s bonds. This led to:

Bond costs are crashing, making it costlier for Ghana to situation new bonds.

Rates of interest (yields) on bonds are spiking—as an illustration, Ghana’s Eurobond yields surpassed 30%, that means borrowing from worldwide markets grew to become unattainable.

Capital flight, as overseas traders pulled out their cash, worsened the cedi’s depreciation.

Credit score Score Downgrades Worsened the Disaster

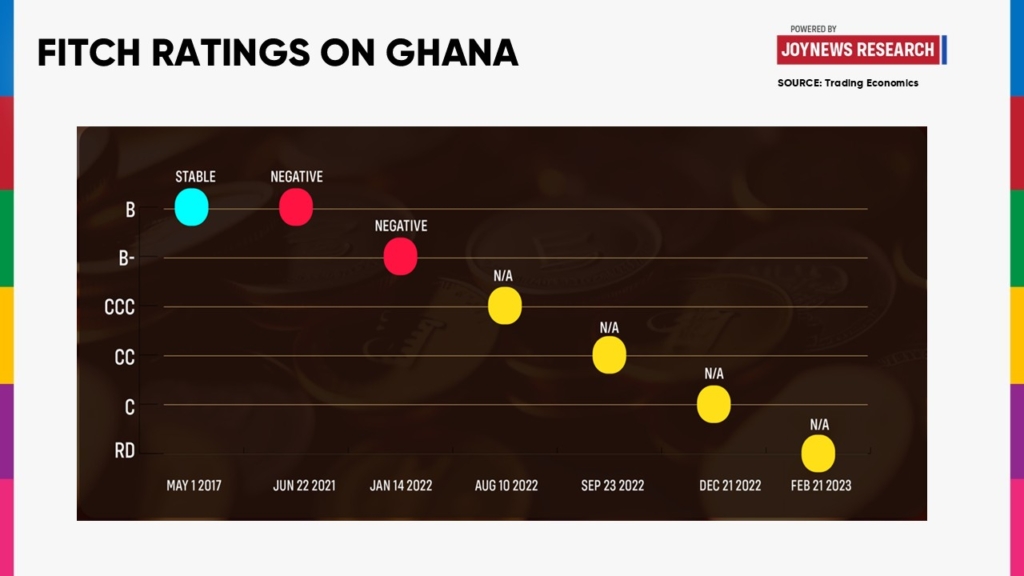

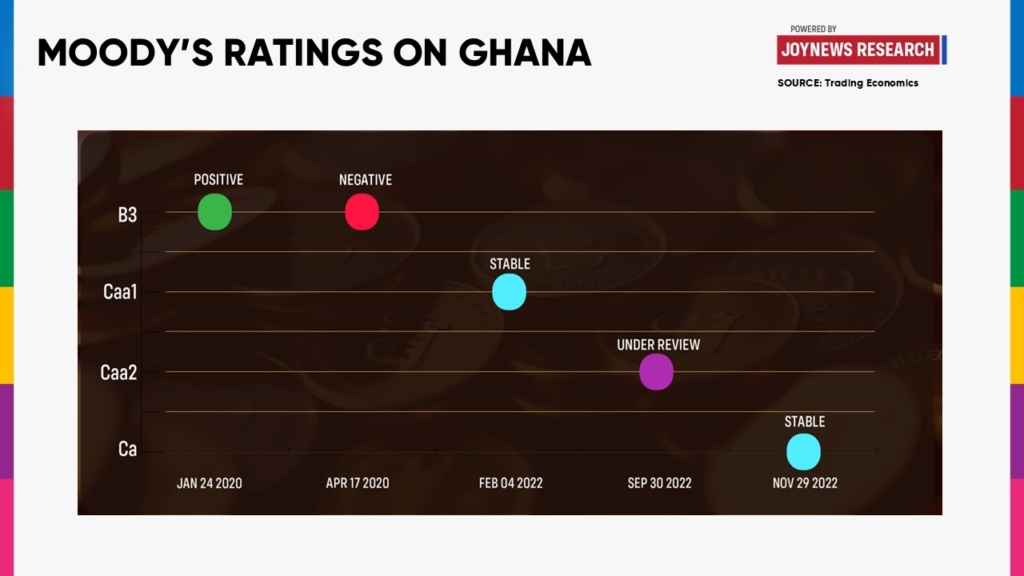

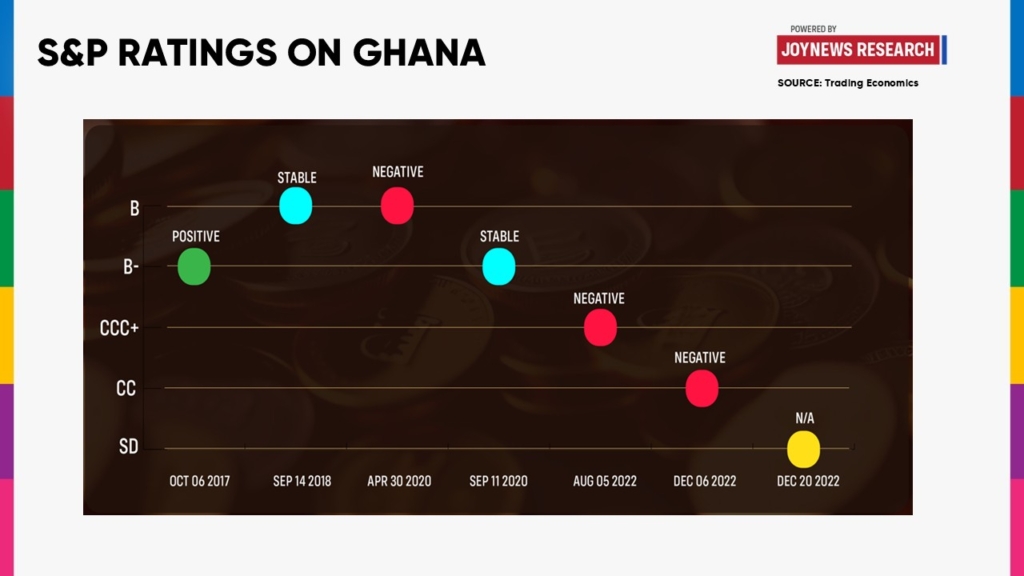

As traders dumped Ghana’s bonds, main credit standing businesses akin to Moody’s, Fitch, and S&P downgraded the nation’s creditworthiness.

- Ghana was categorised as a high-risk borrower, additional deterring potential traders.

- The federal government struggled to safe funding from each worldwide and native sources.

This example created a vicious cycle—investor panic led to bond selloffs, which led to greater borrowing prices, forcing Ghana into a good deeper monetary gap.

Home Debt Alternate Programme (DDEP) & IMF Bailout

By mid-2022, Ghana confronted a liquidity disaster—it may now not afford to service its money owed. To keep away from a full-scale default, the federal government needed to;

- Restructure its native debt by way of the Home Debt Alternate Programme (DDEP), forcing native bondholders (banks, pension funds, and people) to simply accept losses.

- Search an IMF bailout to revive investor confidence and stabilize the economic system.

In December 2022, Ghana formally requested an IMF assist programme, receiving $3 billion in loans in trade for committing to fiscal self-discipline, expenditure cuts, and structural reforms.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially signify the views or coverage of Multimedia Group Restricted.

Source link