Ghana’s cocoa export earnings have seen a dramatic leap in 2025, and everyone seems to be asking the identical query: what’s behind the surge?

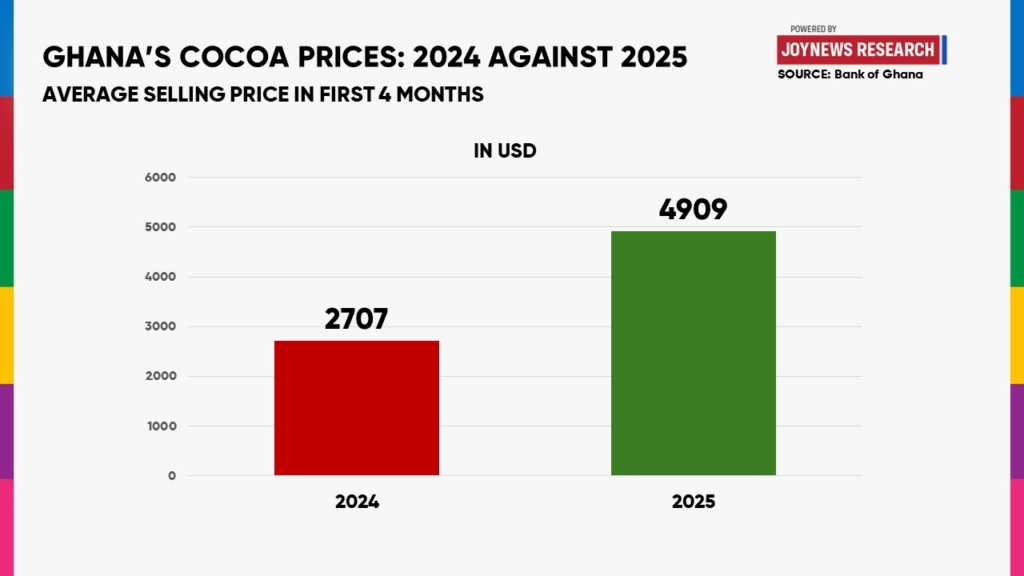

Based on Financial institution of Ghana information, cocoa export revenues for the primary 4 months of 2025 reached $1.84 billion, greater than triple the $579 million recorded throughout the identical interval in 2024. Remarkably, this four-month complete exceeds Ghana’s cocoa earnings for the primary eleven months of 2024.

However how did this occur?

What’s Fueling the Surge?

There’s no single rationalization, however analysts are pointing to a number of key elements:

Decline in smuggling: Improved farmgate costs have made it economically unwise for farmers to smuggle cocoa by unofficial routes, growing the volumes flowing by official export channels.

Clampdown on unlawful mining: The present administration’s efforts to curb unlawful mining (galamsey) have helped protect cocoa farms, boosting potential manufacturing.

Based on consultants, this rise was already projected. The Ghana COCOBOD forecasts cocoa manufacturing for the 2024/2025 market 12 months (October–September) at 700,000 metric tons (MT), a 32% enhance over the earlier 12 months’s estimate of 531,000 MT.

Nonetheless, whereas all these could also be contributing, it is troublesome to make a stable case based mostly on manufacturing alone, since no official manufacturing information for 2025 has been launched but.

What Do We Know?

There are two key markets within the cocoa commerce:

Spot market: Cocoa is bought for fast supply and fee at present international costs.

Futures market: Cocoa is bought for supply at a future date at a pre-agreed value, sometimes based mostly on the typical costs from the earlier 12 months.

Ghana has historically traded by the futures market, which means beans bought this 12 months have been priced based mostly on final 12 months’s common. This method gives stability; if costs fall, Ghana advantages from earlier, increased costs. But when costs rise, Ghana misses out on these positive factors.

That’s what occurred in 2024: cocoa costs surged globally, however Ghana had already bought its beans utilizing 2023’s decrease costs. Because of this, the nation didn’t profit from the worth growth, therefore the low earnings that 12 months, regardless of excessive worldwide costs.

What’s Totally different in 2025?

This 12 months, Ghana stands to learn, regardless of which market it’s working in:

- If promoting by the futures market, final 12 months’s excessive international costs would have influenced increased contract costs, boosting this 12 months’s export earnings.

- If utilizing the spot market, the present market costs stay excessive, which additionally will increase income.

From each situations, Ghana wins.

There are robust indications that Ghana could have shifted away from the futures market and develop into extra energetic within the spot market this 12 months. Why? Ghana was unable to safe its ordinary syndicated loans for cocoa purchases this season. These loans sometimes finance the ahead shopping for of cocoa, which underpins the futures system.

Because of uncertainties in manufacturing capability, pushed by unlawful mining and smuggling dangers, lenders pulled again. Because of this, Ghana has relied extra on the spot market, the place costs are excessive and fee is quicker.

JoyNews checks point out that Ghana is now very energetic in spot market gross sales.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially characterize the views or coverage of Multimedia Group Restricted.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially characterize the views or coverage of Multimedia Group Restricted.

Source link