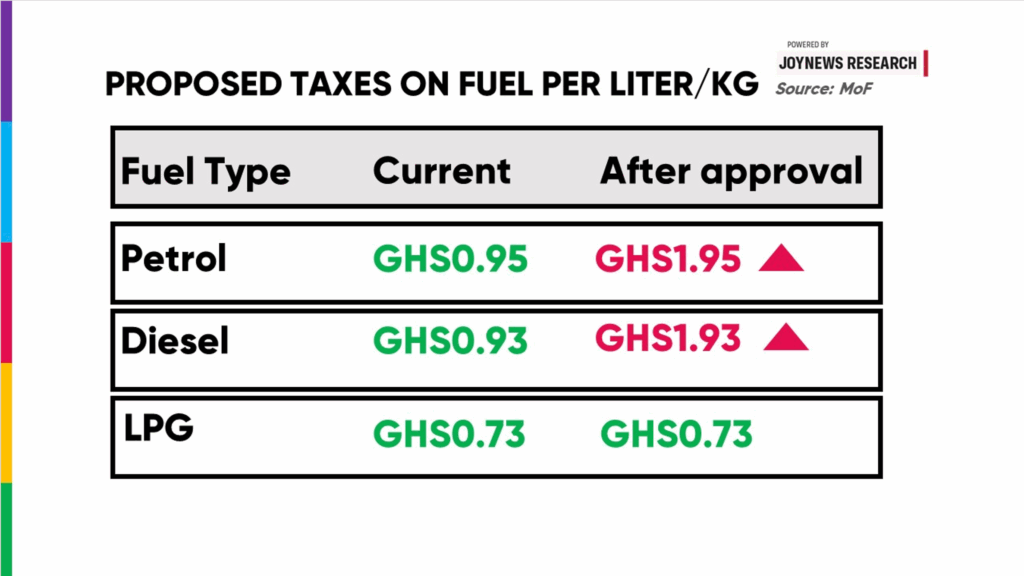

Within the early hours of June 4th, 2025, Ghana’s Parliament accepted a GH₵1 enhance to the Vitality Sector Shortfall and Debt Reimbursement Levy on petrol and diesel.

This modification to the Vitality Sector Levies Act (ESLA), pushed by underneath a certificates of urgency, raises the levy to GH₵1.95 per litre for petrol and GH₵1.93 for diesel.

Liquefied petroleum gasoline (LPG) was excluded.

The Vitality Sector Levies Act, launched in 2015 and applied in 2016, was designed to streamline energy-related taxes and rescue struggling state-owned utilities.

In accordance with the Ministry of Finance, complete collections from all ESLA levies between January 2016 and December 2024 reached GH₵27.2 billion.

In 2025, the federal government expects to gather GH₵9.57 billion, and knowledge obtained by JoyNews Analysis from the GRA reveals GH₵2.1 billion has already been collected within the first 5 months of 2025.

This brings complete collections to over GH₵29 billion.

So why is one other GH₵1 being added to gasoline costs, and the place did all of the earlier billions go?

Unbudgeted, however Handy

The tax hike didn’t seem within the 2025 finances.

In March, Finance Minister Dr. Cassiel Ato Forson explicitly assured Parliament that the levies can be reviewed, however not raised.

“With out rising the levy, we will even evaluate the Vitality Sector Levies Act to consolidate the Vitality Debt Restoration Levy, Vitality Sector Restoration Levy (Delta Fund), and Sanitation & Air pollution Levy into one…”

Lower than three months later, the promise has been damaged.

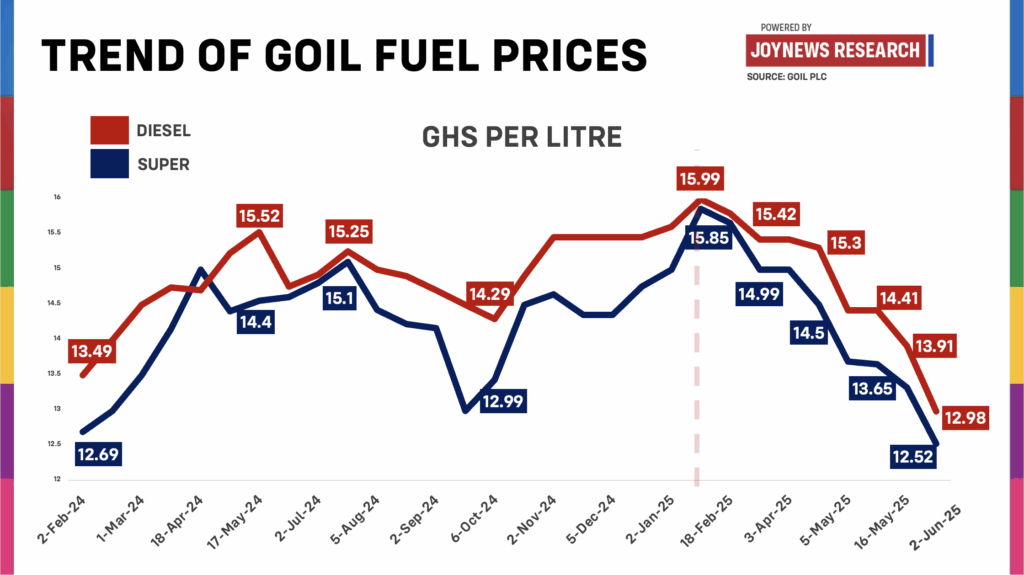

The explanation? Falling international oil costs and a surging cedi have introduced gasoline costs to their lowest ranges in over a yr—giving the federal government cowl to introduce the hike with out triggering public outrage.

At GOIL stations, diesel is now GH₵12.98 per litre and petrol GH₵12.52, down from practically GH₵16 earlier this yr.

Some personal entrepreneurs are even promoting under GH₵12.

The Ministry of Finance believes this creates “fiscal area” for the brand new levy with out inflicting important client backlash. However with transport unions already chopping fares by 15 %, it stays to be seen how drivers will react as soon as the levy kicks in.

A Rising Shortfall

The federal government justifies the GH₵1 enhance as essential to help the widening power sector shortfall and guarantee secure energy provide.

The sector’s deficit stood at $1.46 billion in 2024 and is projected to rise to $2.23 billion in 2025.

Complete gathered power sector debt hit $3.1 billion by March this yr.

An enormous a part of the issue is Ghana’s reliance on costly liquid fuels to energy thermal vegetation. The nation is predicted to spend $1.2 billion on these fuels this yr.

Since these prices fall exterior regulated tariffs, they create a monetary sinkhole—except tariffs rise by as a lot as 50%, a transfer that may be politically unpalatable for any authorities, not to mention a brand new one.

That raises questions.

Why Liquid Fuels?

Ghana has 15 thermal vegetation, most designed to run on pure gasoline. Eight can swap to liquid fuels when gasoline is unavailable. On condition that pure gasoline is cheaper and extra secure, why the shift to costlier options?

Possible explanations embrace provide shortfalls from the Atuabo Fuel Plant or disruptions alongside the West African Fuel Pipeline (WAPCo).

In that case, clearer public communication is required.

Taxing as an alternative of fixing?

Even the Finance Ministry admits the deeper issues are structural: poor income assortment, system losses, weak enforcement of the Money Waterfall Mechanism, and dear technology contracts. Add in underperforming utilities and misallocated subsidies, and the sector turns into a black gap for public funds.

Which begs the query: if these points are recognized, why elevate taxes as an alternative of fixing the system?

Personal sector involvement in electrical energy distribution by the Electrical energy Firm of Ghana (ECG) is being thought of to plug these holes.

But when reforms succeed, will the GH₵1 levy be eliminated?

Or will it quietly grow to be everlasting, like so many “non permanent” taxes earlier than it?

Present Your Work

The federal government insists the brand new levy received’t damage, as a result of gasoline is cheaper and the cedi is robust.

But when both development reverses—if oil costs rise or the cedi slips—the tax might undo current positive aspects in client reduction.

The motive of fiscal stability is sound. However Ghanaians deserve readability: Why are liquid fuels being prioritized over gasoline? Is that this a short-term repair or a long-term technique? What’s the plan for reversing the tax as soon as circumstances enhance?

Above all, transparency is important.

As soon as applied, the general public deserves common updates on how a lot has been raised, how it’s being spent, and whether or not the tax is definitely delivering outcomes.

Extra importantly, If GH₵29 billion didn’t remedy the issue, will yet one more cedi?

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially signify the views or coverage of Multimedia Group Restricted.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially signify the views or coverage of Multimedia Group Restricted.

Source link