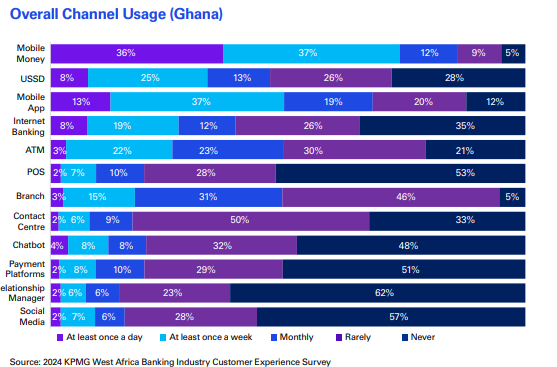

Cell cash is probably the most incessantly used digital platform in 2024, the 2024 West Africa Banking Trade Buyer Expertise Survey has revealed.

This represented a 7-percentage level improve in contrast over the earlier yr.

In line with the report, 73% of Ghanaian customers use it weekly. Thirty two p.c use it for switch of cash, whereas 28% use to pay payments and 54% use it to buy airtime,

For the second consecutive yr, retail banking clients ranked the convenience of transferring cash between their account and cellular pockets as crucial expertise metric highlighting the significance of interoperability between methods.

The survey stated cellular cash interoperability continues to be a key driver of its adoption with the entire worth of cellular cash interoperability transactions rising by 23% as of October 2024.

Once more, the USSD banking can be driving cost interoperability.

The survey revealed that 33% of retail banking clients use USSD banking providers weekly as in comparison with 28% of respondents in 2023. Nonetheless, considerations over service reliability persist, with clients reporting intermittent downtime of their USSD banking channels.

Cell apps, the second most used channel after cellular cash, noticed a slight decline in utilization, with 50% of respondents indicating weekly utilization in comparison with 53% final yr.

Availability of service, ease of use and number of options of cellular apps ranked among the many ten most vital expertise measures for retail clients. Whereas clients admire the comfort and options of banking apps, considerations round reliability stay prevalent.

There was a decline in Automated Teller Machines (ATM) utilization, with month-to-month utilization dropping from 59% in 2023 to 48% in 2024.

Regardless of this lower, clients usually expressed satisfaction with the provision of money and the service uptime when utilizing ATMs.

Whereas general utilization declined, ATMs remained the second most-used channel amongst Gen X and Child Boomers highlighting a generational divide in channel preferences, with older clients persevering with to depend on conventional channels for his or her banking wants whereas the youthful generations want digital channels.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially characterize the views or coverage of Multimedia Group Restricted.

Source link