Shareholders of Ecobank Transnational Integrated (ETI) won’t obtain dividend funds for the Financial institution’s 2024 monetary efficiency, regardless of a record-breaking 12 months and balanced progress throughout all enterprise segments.

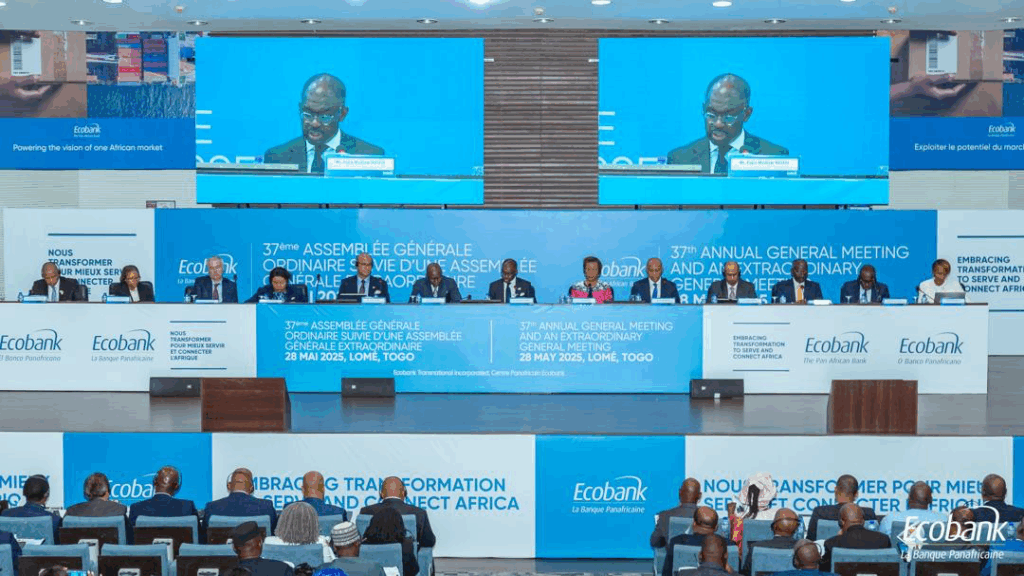

The choice was introduced at ETI’s Annual Normal Assembly (AGM) and Extraordinary Normal Assembly (EGM) held in Lomé, Togo, on Might 28, 2025.

Talking on the AGM, Board Chairman Papa Madiaw Ndiaye described the transfer as “very troublesome,” acknowledging the significance of dividends to shareholders.

“Of the 641,000 shareholders of ETI, about 600,000 personal fewer than 10,000 items and depend on dividend funds,” he famous.

Nonetheless, the Board emphasised that the choice was made in the perfect curiosity of the corporate.

“We wished to strengthen the stability sheet to pave the way in which for accelerated progress. We confronted the troublesome choice of both servicing the debt and complying with current debt covenants or paying dividends,” Mr. Ndiaye defined.

He additional acknowledged shareholder disappointment, including, “Not paying dividends once more is disappointing, and explaining our reasoning is essential.”

2024 Monetary Efficiency

ETI, the mother or father firm of the Ecobank Group, delivered over $2 billion in income for the second consecutive 12 months in 2024.

Revenue attributable to shareholders reached $333 million, representing a forty five% improve at fixed trade charges. Revenue Earlier than Tax climbed to $658 million, a 33% year-on-year improve when adjusted for forex results.

Return on fairness hit a report 32.7%. Buyer deposits totalled $20.4 billion, whereas complete property stood at $28 billion.

All core enterprise segments reported strong progress:

- Company & Funding Banking generated $1.1 billion in income, buoyed by commerce finance, funds, and money administration.

- Shopper Banking added over 1 million new clients and noticed a 15% improve in income.

- Business Banking grew by 12%, pushed by improved lending and transaction banking.

Shareholder Assist for Resolutions

Regardless of considerations raised by some retail traders over the shortage of dividend funds, shareholders overwhelmingly permitted all resolutions offered on the AGM.

These included:

- Approval of the monetary statements and appropriation of earnings for 2024.

- Appointment of an extra auditor.

- Re-election and renewal of mandates for a number of board members.

- Authorisation to lift further funds and amend the corporate’s Articles of Affiliation.

CEO Outlines Development Technique

Group Chief Govt Jeremy Awori reassured shareholders of ETI’s strategic route, pledging to increase buyer entry to present accounts, financial savings and funding merchandise, quicker and extra reasonably priced cash transfers, and monetary planning instruments equivalent to mortgages and wealth options.

“In 2024, we started reorienting the Financial institution to attain these targets, whereas at all times remembering that long-term income progress stays the important thing driver of worth and sustainably excessive returns on fairness,” Awori stated.

He described ETI’s first-quarter efficiency in 2025 as “encouraging,” citing rising return on fairness, falling cost-to-income ratios, and good points from digital investments. He reaffirmed the Financial institution’s give attention to stability sheet strengthening as a basis for accelerated progress.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially signify the views or coverage of Multimedia Group Restricted.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially signify the views or coverage of Multimedia Group Restricted.

Source link