Microchip maker Nvidia stated it could be hit with $5.5bn (£4.2bn) in prices after the US authorities tightened export guidelines to China.

The chip manufacturing big, which has been on the coronary heart of the substitute intelligence (AI) growth, would require licences to export its H20 AI chip to China, which has been one in every of its hottest.

The principles come amid an escalating commerce struggle between the US and China, with each nations introducing steep commerce tariffs on one another masking numerous items.

Nvidia shares plunged nearly 6% in after-hours buying and selling.

Nvidia introduced on Tuesday that the US authorities had instructed it final week that the H20 chip required a allow to be bought to China, together with Hong Kong.

The tech big stated federal officers had suggested them the licence requirement “might be in impact for the indefinite future”.

“The [government] indicated that the license requirement addresses the danger that the lined merchandise could also be utilized in, or diverted to, a supercomputer in China,” Nvidia stated.

The corporate declined to remark additional when contacted by the BBC.

Marc Einstein from the Counterpoint Analysis consultancy stated the $5.5bn hit estimated by Nvidia was according to his estimates.

“Whereas that is actually some huge cash, that is one thing Nvidia can bear,” he stated.

“However as we have now seen in the previous few days and weeks, this may increasingly largely be a negotiating tactic. I would not be shocked to see some exemptions or adjustments made to tariff coverage within the close to future, given this not solely impacts Nvidia however your entire US semiconductor ecosystem,” Mr Einstein added.

Chips remain a battleground in the US-China race for tech supremacy, and US President Donald Trump now needs to turbocharge a extremely complicated and delicate manufacturing course of that has taken different areas many years to good.

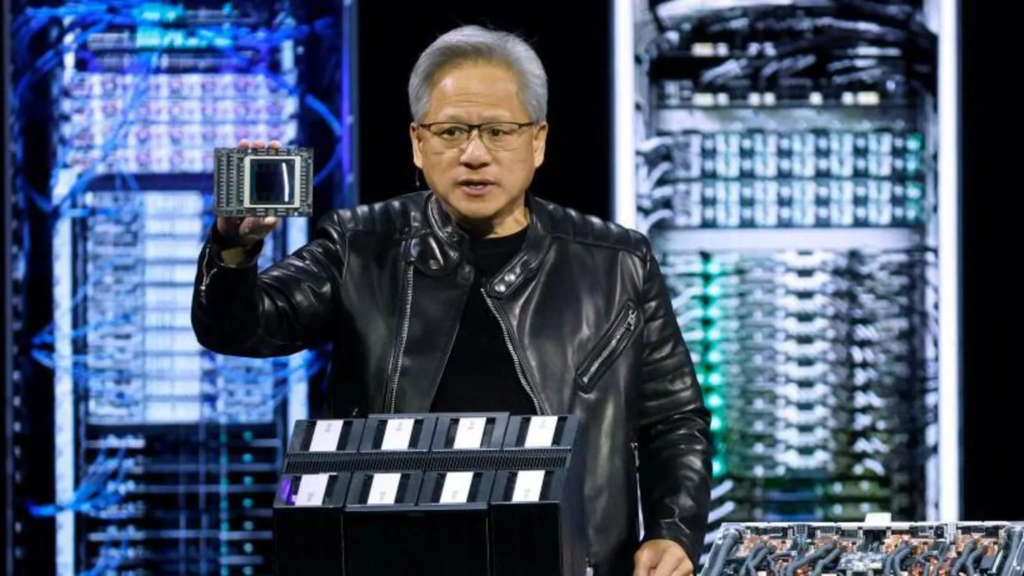

Nvidia’s AI chips have been a key focus of US export controls. Based in 1993, it was initially identified for making the kind of laptop chips that course of graphics, significantly for laptop video games.

Lengthy earlier than the AI revolution, it began including options to its chips that it says assist machine studying. It’s now seen as a key firm to look at to see how briskly AI-powered tech is spreading throughout the enterprise world.

The company’s value took a hit in January when it was reported {that a} rival Chinese language AI app, DeepSeek, had been constructed at a fraction of the price of different chatbots.

On the time, the US was thought of to have been caught off guard by their rival’s technological achievement.

Nvidia stated its $5.5bn prices could be related to H20 merchandise for stock, buy commitments and associated reserves.

Rui Ma, founding father of the Tech Buzz China podcast, stated she expects the US and China AI semiconductor provide chains to be “totally decoupled” if restrictions keep in place.

She added: “It would not make any sense for any Chinese language buyer to be depending on US chips” particularly since there’s an oversupply of information centres in China.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially symbolize the views or coverage of Multimedia Group Restricted.

Source link