Prof. Peter Quartey

Professor Peter Quartey of the Institute of Statistical Social and Financial Analysis (ISSER), College of Ghana, has urged policymakers to impose a strict debt ceiling, implement prudent monetary administration methods, and strengthen institutional oversight over the nation’s sources.

He’s additionally emphasising the necessity for better transparency in public procurement and higher planning for capital tasks to keep away from misallocation of sources.

Prof. Quartey made the suggestions when he delivered a thought-provoking evaluation of the nation’s borrowing practices and its results on funding and development on the 2025 Ghana Academy of Arts and Sciences Inaugural Lecture, the place the rising debate over Ghana’s debt sustainability took centre stage.

Underneath the theme “Debt, Funding, and Development in Ghana: Did We Borrow to Eat?”He examined whether or not Ghana’s growing debt ranges have translated into productive investments and concluded, invariably, that they haven’t.

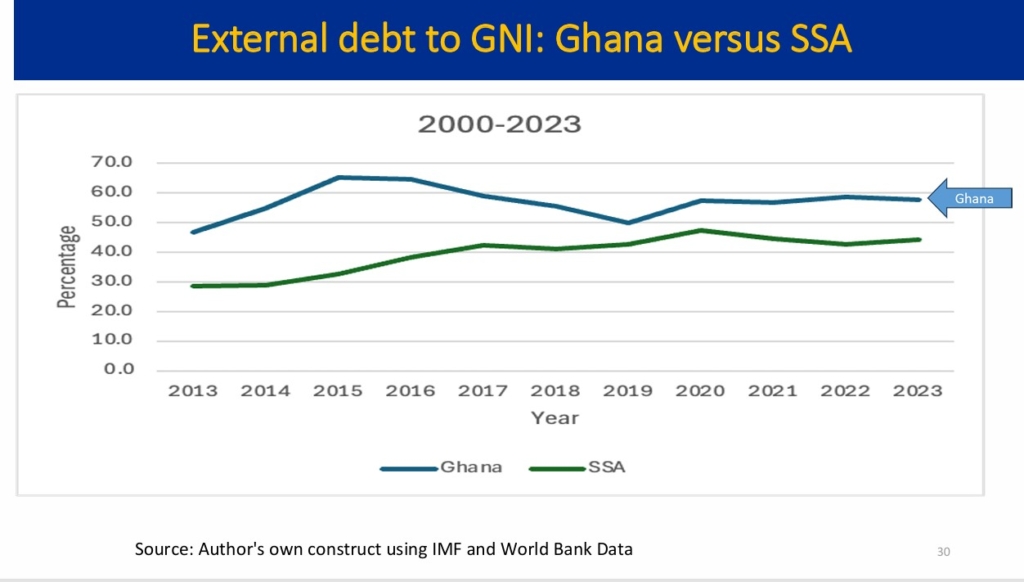

Over the past decade, Ghana’s debt-to-GDP ratio has soared, reaching unsustainable ranges.

He argued that whereas borrowing is a vital software for financing improvement, Professor Quartey careworn that its advantages rely on how successfully funds are allotted.

Prof. Quartey argued that extreme debt can act as a “tax on funding,” thereby discouraging financial development if it isn’t correctly managed.

Ghana’s capital expenditure, which ought to ideally drive infrastructure and financial growth, has plummeted.

In 2010, it stood at 6.9% of GDP, however by 2023, it had declined to simply 2.4%. Regardless of securing substantial loans, the nation has struggled to put money into long-term development tasks.

Professor Quartey used three case research for example the significance of monetary self-discipline, recounting the story of an extravagant tech entrepreneur who squandered his fortune, and contrasted it with that of Ronald Learn, a modest janitor who accrued wealth by strategic investing.

The lesson, he stated, was clear: monetary success hinges extra on behaviour than intelligence, a precept that he stated additionally applies to nationwide financial administration.

Ghana has undertaken a number of main tasks funded by exterior loans, together with the Sinohydro and Afreximbank agreements. Nevertheless, many of those initiatives have confronted delays and price overruns.

He stated the Pwalugu Multi-Goal Dam challenge, as an illustration, meant to enhance electrical energy technology and irrigation, is but to take off six years after its approval, elevating questions concerning the effectivity of public funding

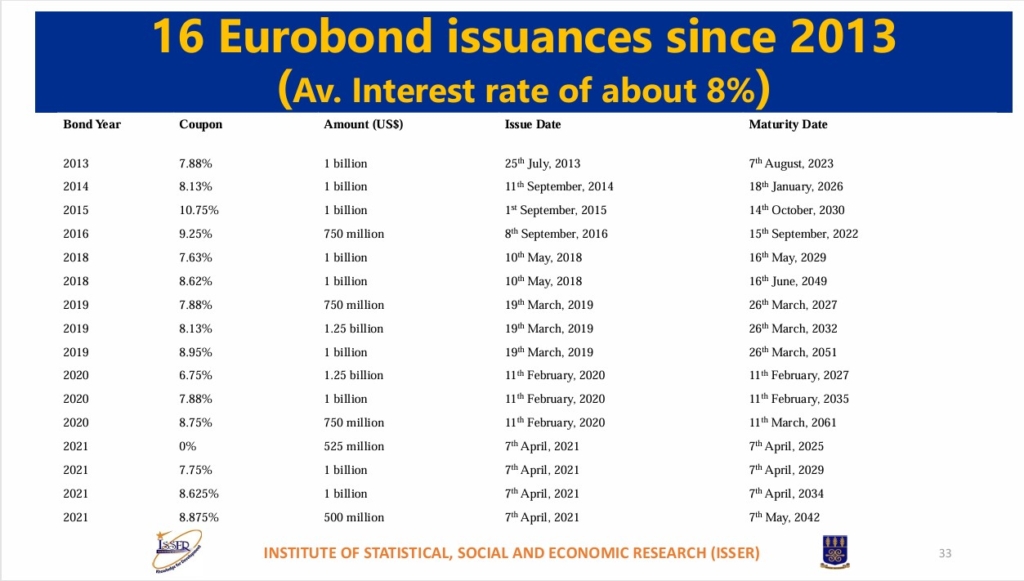

Prof. Quartey additionally highlighted the shift in Ghana’s borrowing patterns, with a transfer away from concessional multilateral loans in the direction of costly worldwide capital markets.

This shift, he argued, necessitates a crucial reassessment of whether or not borrowed funds have been invested in high-return investments or merely used to service current money owed and fund recurrent expenditure.

He cautioned towards the federal government returning to the capital market any time quickly.

“The effectivity of funding is paramount. Ghana’s problem is just not merely borrowing however how the funds are allotted and managed,” he famous.

He additionally identified cases of inefficiencies in public monetary administration, citing extravagant expenditures and the dearth of aggressive procurement processes.

Past the necessity for debt ceiling, Prof Quartey additionally referred to as for the strengthening of public monetary administration and diversifying exports to cut back reliance on exterior borrowing.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially symbolize the views or coverage of Multimedia Group Restricted.

Source link