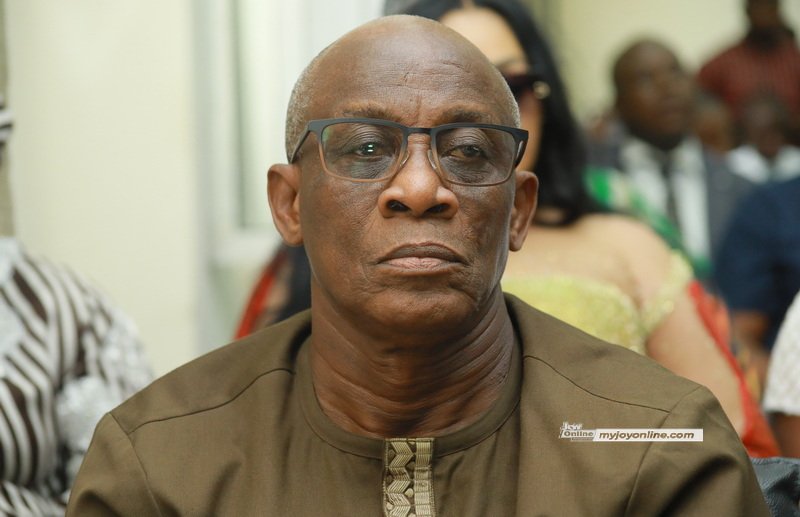

Former Finance Minister and financial advisor to President John Mahama, Seth Terkper, says no authorities can handle an financial system for 4 straight years with out dealing with a disaster.

He insists that the check of fine financial administration just isn’t avoiding shocks, however being ready once they strike.

“You can not handle an financial system repeatedly for 4 years with out one disaster,” he said pointedly on JoyNews’ PM Categorical Enterprise Version on Thursday night time.

Based on him, President Mahama has been cautioning that though issues look like going nicely, Ghana should put together for the inevitable downturns.

“President John Mahama is saying issues are going nicely, let’s watch out,” Mr Terkper defined.

“Let’s make it possible for, you understand, we’ve got reserves…Reserve, which is a sacrifice. To set reserves, as in households, as in companies, is a sacrifice.”

Seth Terkper mentioned constructing buffers have to be a deliberate act, as a result of shocks will come. He cited the COVID-19 pandemic for instance.

He argued that stability just isn’t sufficient — reforms have to be sustained. “It’s good to stabilise and to maintain reforms,” he added.

“However sustaining reforms means it’s essential to put together for the draw back. You don’t run a rustic on simply good days.”

On income, Terkper pressured that Ghana’s tax-to-GDP ratio is simply too low for a middle-income financial system.

“Our income as we speak — and I’m speaking income, not tax income — is about 15%. Tax-to-GDP is round 17–18%. However for an African middle-income nation, it shouldn’t be 15%.”

He blamed a part of the shortfall on short-term income measures being handled as everlasting.

He defined how in troublesome occasions, governments use short-term taxes to assist the finances, however these have to be eliminated as soon as the financial system recovers.

“We now have had a brief levy coverage…You employ them throughout austerity, and you then take away them,” he mentioned. “They’re much like your counter-cyclical measures.”

He pointed to the monetary sector levy launched throughout COVID.

“That’s while you acquired your FinSec levy,” he recalled. “As a result of it isn’t the entire sector that’s depressed. There’s a sector that’s doing nicely on account of us being at residence…So you place a brief levy on it.”

He warned towards failing to reverse such taxes when circumstances enhance.

“A time will come when COVID will probably be over… Sure, there’s nonetheless some stability in using Zoom and others, however it isn’t on the peak.”

Seth Terkper’s central message was certainly one of preparation. He mentioned it’s not sufficient to easily get pleasure from the advantages of financial stability.

“Are we getting ready for the following disaster?” he requested. “Have we put some reserves, studying from COVID, in order that when one thing else comes, we fall on these reserves to handle it?”

He was clear that managing reserves just isn’t manipulation. “You’re solely managing the financial system due to the upside and the draw back,” he mentioned. “That’s sound financial planning.”

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially characterize the views or coverage of Multimedia Group Restricted.

DISCLAIMER: The Views, Feedback, Opinions, Contributions and Statements made by Readers and Contributors on this platform don’t essentially characterize the views or coverage of Multimedia Group Restricted.

Source link